THE INFLATION REDUCTION ACT – The US Senate passed the Inflation Reduction Act on August 7, 2022, The Act has been claimed to be designed to reduce living costs for American families while fighting inflation and reducing the deficit. It will expand affordable healthcare coverage, cap the price of insulin, and lower energy costs.

The Act also makes historic investments in its pledge/agenda to reduce carbon pollution by 40% by 2030 and accelerate the transition to clean energy. The $369 billion in climate and clean energy provisions has the largest allocations ever passed by Congress.

The Inflation Reduction Act was passed with provisions to raise taxes on the largely profitable corporations and individuals, rather than the middle-income families and small businesses. For example, corporations that make a profit of at least $1 billion per year will be issued a 15% minimum tax.

Some industrial businesses will also be beneficiaries of the bill, as tax credits will be awarded to those who make significant investments in green energy, such as electrifying their fleets.

Meanwhile, investments in new manufacturing facilities and efforts to support the production of technologies on home soil should help strengthen domestic supply chains, create new jobs, and boost American competitiveness.

Hopefully, having a positive impact the nation’s manufacturers.

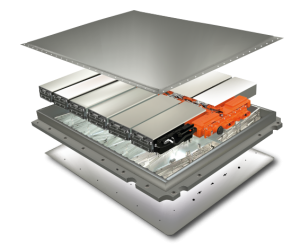

THE ACCELERATION OF THE CRITICAL METALS IN EV BATTERIES – Legislation within the Inflation Reduction Act that is designed to accelerate transportation electrification has large implications for the EV industry as a whole.

The Act extends the light-duty EV tax credit, which awards up to $7,500 per vehicle at the point of sale, through 2032. A cap that previously limited tax credited sales-per-automaker to 200,000 has also been rescinded, benefitting the likes of Tesla and General Motors.

Federal tax credits are now available for commercial EVs for the first time. The Act allocated $3 billion for the U.S. Postal Service to electrify their fleet, and $1 billion will be distributed to states, municipalities, Indian tribes, or non-profit school transportation associations to replace class six and seven heavy-duty vehicles with EVs.

But there are some important stipulations in the legislation. For starters, the light-duty EV tax credit has an income cap, so that individuals that earn more than $150,000 annually are not eligible for the credit. Legislators say that they hope, by capping the credit allowance, that automakers will be incentivized to reduce the prices of EVs to reach a wider and more diverse customer base.

The total EV market share reached just 6% in October 2022, a long way from the 2030 goal of 50%.

As of 2023, automakers must also source or process at least 40% of their EV battery components in the U.S. or countries with which the U.S. has a free trade agreement. That number increases to 50% in 2024, 80% in 2027, and 100% by 2029. These conditions, and an additional one that requires the final assembly of EVs to take place in North America. Legislative hopes that the provisions of the requirements will incentivize automakers to reshore supply chains.

This sounds like good news for the U.S. manufacturing industry. The question is whether suppliers of EV battery components will be able to keep up with a sudden surge in demand.

More Stories

What is the latest technology news in Florida manufacturing?

Keys to Success Thursday March 6, 2025

What’s Ahead for Manufacturing in 2024?